What We Do

Improve Financial Stability For Everyone

What We Do

Improve Financial Security For Everyone

Together, we have the power to ease economic hardship for our most susceptible community members by offering opportunities for employment, income, and resources to attain financial stability.

What we're up against

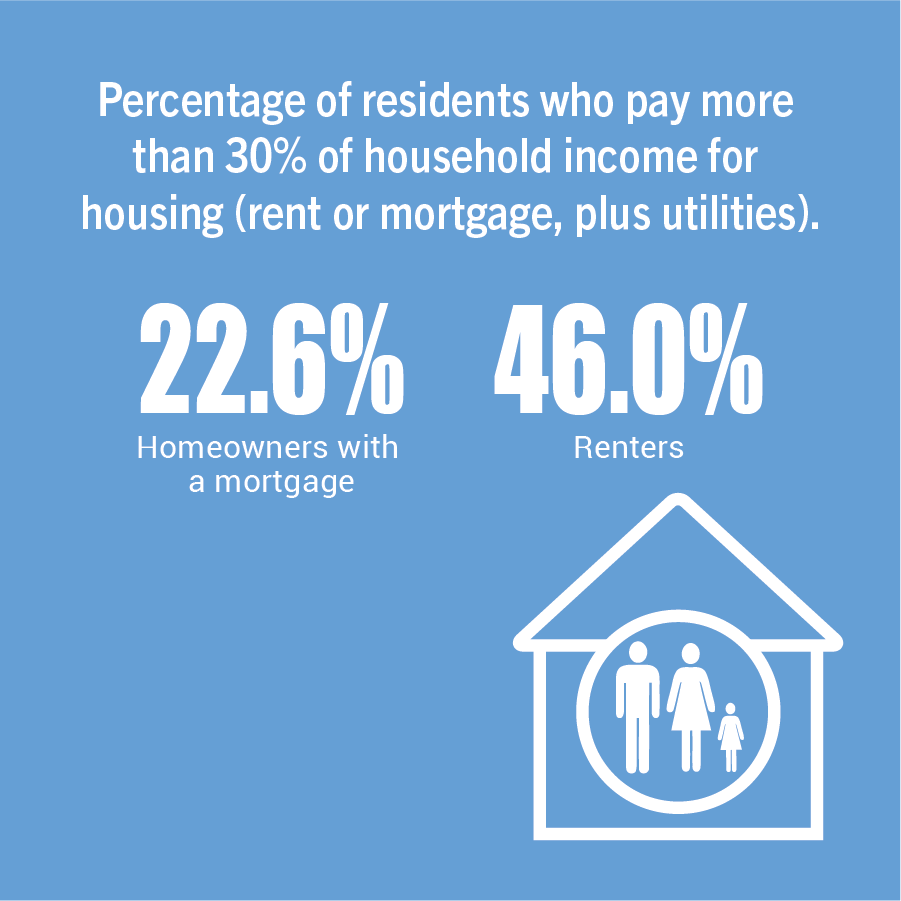

Kennebec County, Maine, is a wonderful place to live, work and play, but many of our neighbors and friends cannot make ends meet. Safe, affordable housing is hard to find, and as of 2022, 26% of households in our community are paying more than 30% of household income for housing (rent or mortgage, plus utilities).

By tracking these data points over a 10-year period and in collaboration with Impact2032, our goal is to decrease the percentage of households paying more than 30% of household income for housing to 23%.

Together, we have the power to ease economic hardship for our most susceptible community members by offering opportunities for employment, income, and resources to attain financial security.

What we're up against

Kennebec County, Maine, is a wonderful place to live, work and play, but many of our neighbors and friends cannot make ends meet. Safe, affordable housing is hard to find, and as of 2022, 26% of households in our community are paying more than 30% of household income for housing (rent or mortgage, plus utilities).

By tracking these data points over a 10-year period and in collaboration with Impact2032, our goal is to decrease the percentage of households paying more than 30% of household income for housing to 23%.

How We Make It Better

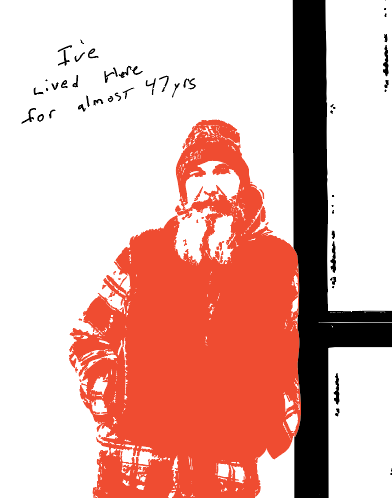

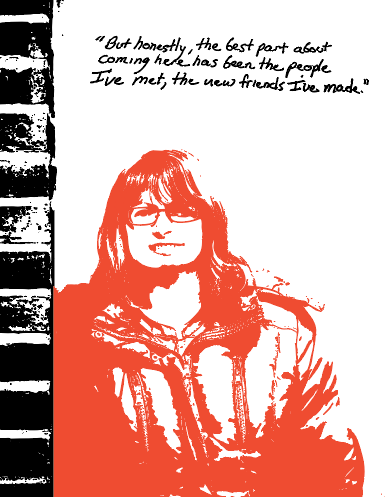

FACES OF ALICE

This year’s UNIGNORABLE campaign amplifies the voices and experiences of our ALICE neighbors – Asset Limited, Income Constrained, Employed – right here in our community. Continuing the visual storytelling from last year, this campaign features powerful imagery, including poignant black and white photography by Augusta’s own Dave Dostie.

You’ll find compelling stories shared directly in their own words, including Pablo’s, which is part of a larger project by Amanda Bartlett and Dave Dostie called Echoes of Hope: Voices of Augusta’s Unhoused, offering a deeper look into the lives of our community members. You can find more stories from that important project here:

https://www.facebook.com/profile.php?id=61571363322648.

Through these narratives, we invite you to truly see and understand the daily realities faced by ALICE. Join us in making both ALICE and the issues they navigate in today’s challenging economic climate UNIGNORABLE.

PABLO

Augusta, Maine

SARA

Oakland, Maine

Help make Pablo

UNIGNORABLE

I’ve lived here in Augusta almost 47 years. I’ve worked for a few different people here in town doing foundation work and roofing. It makes for a good environment when everyone is having fun on the jobsite instead of people fighting all of the time. I’ve worked outside all my life and I’d rather be outside than inside.

15 or 16 years ago, something like that, I got my head caved in. I had somebody thrown out of a bar for giving a girl a hard time and him and another guy caught up with me about a month later. It happens though. I’m not the only one that’s happened to. That’s the biggest part of why I’m not working. After that I had no balance. I couldn’t do the work. I used to do work on ladders and on the roof. You’ve got to balance up there.

Help make Sara

UNIGNORABLE

My name is Sara, and for five years now, I’ve been coming to

the Waterville Essentials Closet. I’m from Oakland in Kennebec County. After I lost my job as a personal support specialist, helping people with their in-home health, things got tough. I’m on Social Security Disability, and MaineCare only covers so much. I knew I needed help right away, and the Essentials Closet provided the very products I needed, immediately easing that financial burden. It all adds up with a limited income, that financial stress. But honestly, the best part about coming here has been the people I’ve met, the new friends I’ve made. It’s really increased my sense of belonging in the community.

Being part of an ALICE household means I also utilize the local food pantries to stretch my monthly budget. I also get help from KVCAP with heating and energy costs, and I’ve applied for Section 8 housing. It really shows how many of us are just trying to make ends meet. I know I was one of 312 households – 800 people – who came in within the first six days the Waterville Essentials Closet was open this year. It just shows you the great need in our community. In fact, the Essentials Closet has served over 2,400 different households, which represents more than 4,800 family members.

Many of these household representatives come back each month, and some every few months. The Essentials Closet also welcomes new people every month. The volunteers here are not paid, and they are so compassionate and non-judgmental. My message to anyone who needs it is this: so many people use this place – single mothers, fathers, single people, senior citizens, disabled individuals, retirees, asylum seekers, blended families, friends of present and past, neighbors, and transgender individuals – if you need help, reach out and get the help you need.

This is here for everyone.

25.8%

Percentage of households paying more than 30% of household income for housing (rent or mortgage, plus utilities).

Help make Affordable Housing

UNIGNORABLE

Access to affordable housing feels impossible to obtain, like a relentless game of cat and mouse. The housing you need always seems just beyond your reach, slipping away as you chase it. Rising rents, long waiting lists, and strict qualifications create a barrier that feels insurmountable.

As you struggle, your situation worsens. You face difficult choices between paying for temporary shelter, food, or other essentials. The stress and uncertainty weigh heavily, affecting your mental and physical health. Financial insecurity compounds the problem, making it hard to maintain a job, secure childcare, or attend medical appointments.

The elusive nature of affordable housing leaves you feeling powerless, as if you are constantly falling farther away from securing a stable home. Living in this state means enduring a perpetual chase, where the promise of affordable housing remains just out of reach. The desperation and frustration grow, leaving you feeling more isolated and overwhelmed. The dream of having a place to call home feels distant, overshadowed by the struggle to survive each day.

727

Number of evictions.

Help make Homelessness

UNIGNORABLE

Homelessness can feel like a constant downward spiral, driven by mental health challenges, lack of education, and financial instability. These factors create a vicious cycle, making it increasingly difficult to secure stable housing. With rental prices skyrocketing, more people find themselves homeless through no fault of their own.

Being homeless worsens financial insecurity and deteriorates mental and physical health. The stress of finding shelter and necessities takes precedence over employment or education, trapping individuals in poverty. Homelessness also strains social relationships, leading to isolation and hopelessness.

The impact extends beyond the individual. Communities with high homelessness rates face increased pressure on public services, reduced economic growth, and heightened social tensions. The visibility of homelessness affects community morale, leading to insecurity and neglect.

Homelessness is not just a personal crisis; it’s a community issue. Addressing it requires comprehensive support systems, affordable housing, and accessible mental health and education services. By tackling the root causes and providing stable, affordable housing, we can break the cycle and improve overall community well-being.

41%

Percentage of households in Kennebec County that fall below the ALICE Threshold (poverty + ALICE).

Help make Financial Security

UNIGNORABLE

Imagine moving through life, paycheck to paycheck. Missing a single paycheck feels like the bridge beneath you has collapsed, sending you into a freefall. The descent is rapid and terrifying, with bills piling up like jagged rocks below, each one adding to your fall.

As you fall, you must make impossible choices: housing, food, gas, medical appointments, or child care. Each decision feels like sacrificing one necessity for another, with no good options. Housing keeps a roof over your head, but without food, you can’t sustain yourself. Skipping medical appointments might save money now but could lead to severe health issues later. Child care is crucial, but without gas, how do you get to work?

Debt pulls you down further, with each missed payment increasing your fall. Interest rates, late fees, and mounting debts create a crushing burden, making it harder to find a foothold. The fear of losing everything becomes all-consuming. Living paycheck to paycheck means constantly moving forward, where any misstep can send you spiraling into financial freefall, leaving you feeling vulnerable and powerless, desperately seeking security.

COMMUNITY PRIORITIES

Skills For Employment

Stable Income

Tools For Independence

COMMUNITY PRIORITIES

Skills For Employment

Stable Income

Tools For Independence

Help us improve financial stability for everyone!

Help us improve financial security for everyone!

FINANCIAL STABILITY PARTNERS

United Way of Kennebec Valley partners with 12 agencies throughout our community that specifically help people improve their economic stability. UWKV funds one or more program through the following organizations that are focused on improving financial stability across Kennebec County.

211 Maine

Alfond Youth & Community Center

Bread of Life Ministries

Capital Area New Mainers Project

Emmanuel Lutheran Episcopal Church/Bridging the Gap

First Congregational Church, UCC of Waterville, Maine

Goodwill Industries of Northern New England

Kennebec Valley Community Action Program (KVCAP)

Kennebec Behavioral Health

Legal Services for the Elderly

Maine Children’s Home

Rural Community Action Ministry

FINANCIAL SECURITY PARTNERS

United Way of Kennebec Valley partners with 12 agencies throughout our community that specifically help people improve their economic security. UWKV funds one or more program through the following organizations that are focused on improving financial stability across Kennebec County.

211 Maine

Alfond Youth & Community Center

Bread of Life Ministries

Capital Area New Mainers Project

Emmanuel Lutheran Episcopal Church/Bridging the Gap

First Congregational Church, UCC of Waterville, Maine

Goodwill Industries of Northern New England

Kennebec Valley Community Action Program (KVCAP)

Kennebec Behavioral Health

Legal Services for the Elderly

Maine Children’s Home

Rural Community Action Ministry